Managing God’s Resources

Everything that we have belongs to God. He has called us to be faithful “managers in trust” of the abundance that he has blessed us with. For all Canadians, being faithful stewards includes “estate planning”, or making plans for the faithful and orderly disposal of one’s estate upon death. In the following information, we would like to present you with a number of options to carefully plan for the faithful use of what God has given you. You will read about ways to leave “A Living Legacy” by impacting the Kingdom with your estate after your passing, as well as ways to direct “Gifts Beyond Cash” (stocks, securities, etc.) during your lifetime. Each of these ways to give may have significant tax advantages for you and your loved ones. Please prayerfully consider how you might partner with Word & Deed as you faithfully manage what God has given you.

Word & Deed highly recommends that you consult with legal and financial advisors while making decisions about the gifts described here.

Charitable Bequests

A charitable bequest allows you to name Word & Deed as a beneficiary under your will. You could specify a designated amount or a percentage of your estate in your will. Another approach is to add a child named “Charity” to your will, designate the inheritance for that “child” and then list the charities you plan to support in a document separate from your will. This allows for you to make changes to the list of charities benefiting from your legacy without going through the trouble of changing your will.

Upon receipt of the gift, Word & Deed will provide the estate with a tax receipt in the amount of the gift which can then be used to offset tax liabilities that accrue on death.

If you are interested in making a bequest to Word & Deed in your will, here is the wording you could use:

I hereby give to: Word & Deed Ministries Canada Inc., charitable registration number 891200941RR0001 [a specified amount] OR [a specified percentage] of the residue of my estate, to be used in fulfillment of its proper purpose. If at the time of distribution, the organization named in this my Will to receive a bequest has amalgamated with another organization or organizations or has changed its name or location of its work, this said bequest shall not fail but my Trustees shall in their sole discretion pay the same to the organization they deem to be the successor organization.

Gifts of RRSPs and RIFs

RRSPs are handy vehicles that, during your lifetime, allow you to manage your taxable income in any given year. However, upon death, they can become a problematic tax liability. For example, if one does not have a spouse to transfer an RRSP or RIF to, the funds within the RRSPs or RIFs become fully taxable in the year of one’s death.

In light of these circumstances, the ITA now permits donors to name a charity as a beneficiary of their RRSPs and RIFs. In this scenario, the proceeds of the RRSPs and RIFs are paid directly to the charity on death.

Upon receipt of the gift, the Word & Deed will issue a tax receipt for the value of the RRSPs and RIFs to the estate of the donor. The taxes payable by the estate for the disposition of the RRSPs and RIFs on death is then eliminated as a result of the charitable receipt received.

Gifts of Life Insurance

You can name Word & Deed as a beneficiary of your life insurance policy. When you pass away, the proceeds of the policy are paid to Word & Deed and issues a charitable receipt for the funds received to your estate. Donors often consider this form of gift where they are likely to accrue a large tax liability on death, to offset the taxes payable.

Gifts of Appreciated Securities

“Praise God for what He is doing to expand Christian education and the opportunity to witness for Christ among the Muslims in Indonesia. We pray that He will continue to use us as a tool to bring more people to Christ and to grow his church in this nation.”

“I love the education material that Word & Deed publishes and shares. It is a wonderful way for my 7th-grade geography students to learn the history of a country, but also to learn about the creativity of God through different cultures.”

“This past year Word & Deed took the initiative to work out a very important project that would place theology books in the hands of pastors across Latin America… I wish to congratulate Word & Deed for their sensitivity to such fundamental needs in the church of Latin America. Good theology will produce healthy churches. We need to always work on the foundations. On behalf of CLIR, we look forward to continued cooperation in the future.”

“When I was in Grade 4, I heard a presentation about the Adoration School in Haiti. That made me think about the children of my age that don’t have the privilege of going to school as I do. The question came into my mind how to raise money for them…. Then in the summer of 2020, I started my HJK Landscaping Service and went to my neighbors and worked for them. My business worked out well, so I decided to put away 10 percent of all the money I received and give it to the Adoration School in Haiti.”

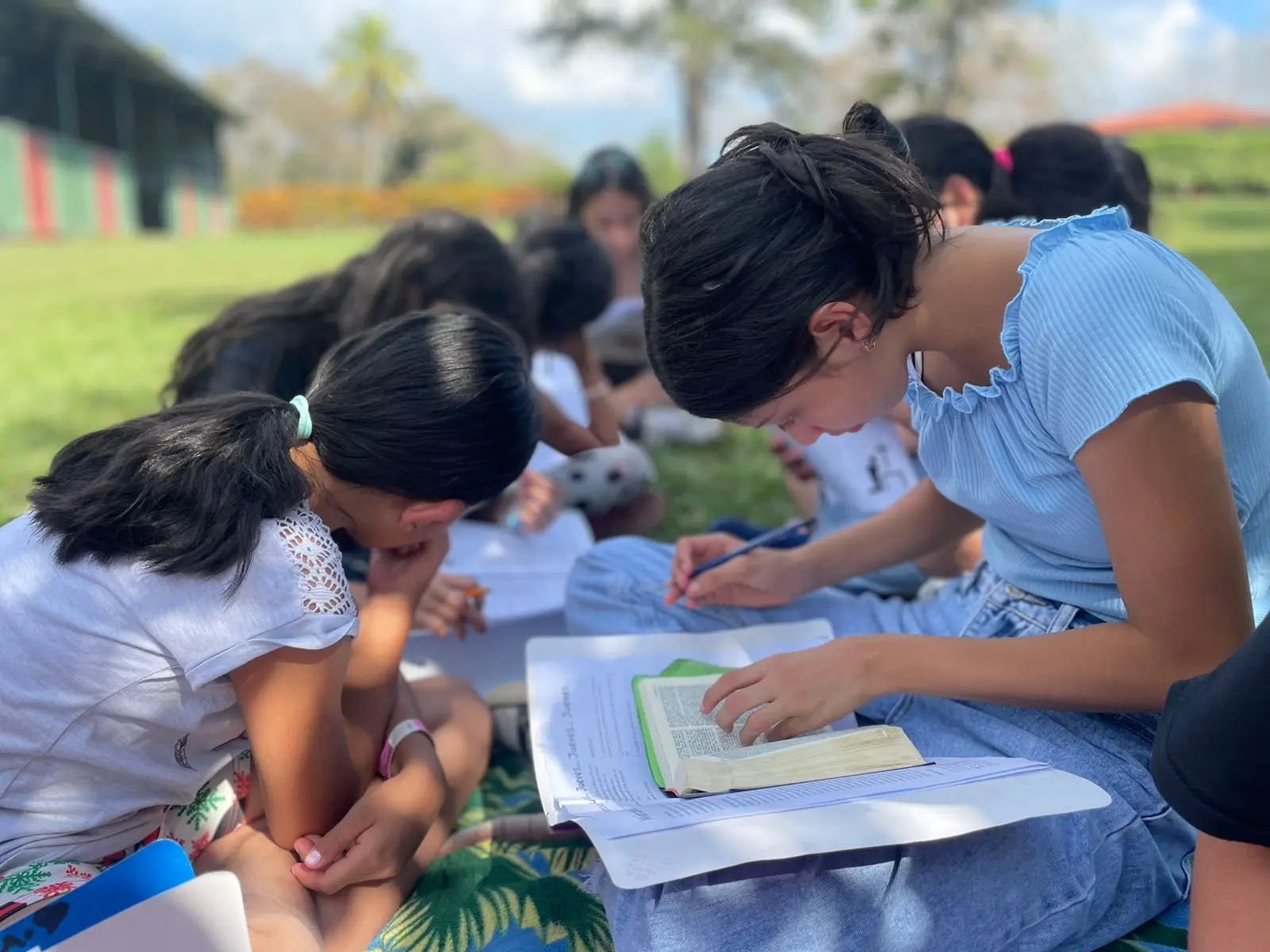

“In school, I have been taught the Word of God, which is very important to my life and that of my family. I feel happy because the teachers at La Palabra treat me very well.”

“I would like to thank the supporters of the mission for the help that they bring into my life. I love the Bible studies and learning the stories of the Bible. The groups from Canada and the USA are such a blessing and we love the games that they teach us and the Bible crafts that we do. I have been in this project for four years now and I love the Word of God… Jesus is the only hope that I have.”

“We can only say thanks, because without a doubt, the Family Protection Team arrived at the right time. We felt listened to, understood, and above all we were able to recognize that God is the basis of our home. With Him restoration becomes complete and we can be a happy family.”